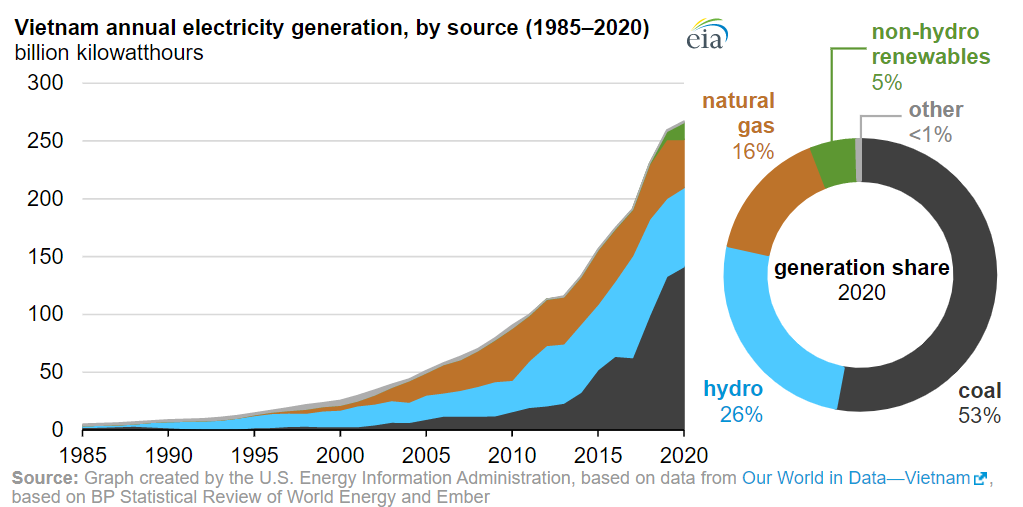

Vietnam’s electricity demand has increased at a rapid pace—an average of 10 percent per year over the past five years. To keep up with demand, the country will need a significant amount of new capacity, requiring $150 billion in capital investments for generation and grid upgrades, according to Electricity of Vietnam (EVN’s) estimates. Given the country’s natural hydro endowments and lower-cost solar and wind power, Vietnam may be wise to pursue renewables as it decides a future power plan.

In our recent review of Vietnam’s power sector, we determined that a renewable-led plan would present the country with the best opportunity for capital formation while posing the lowest risk and impact on public budgets.

Vietnam has tremendous natural endowments: four to five kilowatt-hours per square meter for solar and 3,000 kilometers of coastlines with consistent winds in the range of 5.5 to 7.3 meters per second. Yet, the country’s own market for renewables remains in its infancy, with only about 200 megawatts of grid-scale, renewable solar and wind capacity online, primarily through wind projects. Most of Vietnam’s renewable energy generation capacity, some 3.4 gigawatts annually, is intended for export to Europe and the U.S.

A successful renewables-led pathway includes building out the country’s wind and solar generation capabilities (39 gigawatts and 61 gigawatts by 2030, respectively). This is five times more than what is called for in Vietnam’s current energy plan—which aims by 2030 to increase coal by 45 gigawatts—and would need to be supplemented by natural gas and battery storage to help firm renewables generation.

Here’s how a renewables-led pathway outperforms Vietnam’s current energy plan

- Cheaper. Vietnam would save 10 percent in overall power costs through 2030.

- Cleaner. A renewables-led pathway would yield 1.1 gigatons fewer greenhouse gas emissions and 0.6 megatons fewer particulate emissions through 2030. It would also significantly lower sulphur-dioxide and nitrogen-oxide emissions. In the current power plan, the significant increase in emissions would have a serious impact on Vietnam’s air quality, which is already among the worst in Southeast Asia.

- Fuel security. With a renewables-led plan, Vietnam would rely on 28 percent less total fuel and 60 percent fewer imports than in the current plan—reducing the country’s dependency on fuel imports and fossil fuels, more broadly.

- Job creation. Renewable investment will create an additional 465,000 jobs through 2030, approximately twice as many jobs for the same level of investment as in the current plan.

Steps to pursuing a renewables-led pathway in Vietnam

Renewables are generally seen in global markets as less risky investments, rewarded by lenders with a much lower cost of capital due to low operating costs allowing renewables to take share from carbon-generating assets. But in Vietnam, the higher cost of capital is limiting its ability to attract significant foreign direct investment, therefore limiting potential renewable developers.

To create a financial and regulatory infrastructure that makes the market attractive to capable renewable developers, the government could consider the following:

- Develop a more attractive Power Purchase Agreement (PPA) for renewable energy. The current PPA forces project developers to shoulder the majority of the risk. Several potential project developers interviewed for our report said these risks make raising capital extremely difficult. Usually, there is room for developers to negotiate, but the current renewable PPA comes as a “take-it-or-leave-it” option. A bankable PPA is a key factor in opening the door to capital investment at the levels needed to build a mature renewables industry in Vietnam.

- Clarify the future of renewables tariffs after July 2019. To be eligible for the current feed-in tariff, solar projects must be ready for commercial operation by the end of 2020. There is little incentive today for developers to act quickly, for fear they might miss the deadline and therefore wind up ineligible for the feed-in tariff.

- Design an easy-to-navigate, transparent, and replicable project-approval process. Interviewees note that the current approval process is confusing, opaque, and circuitous, requiring an usually large amount of stakeholder engagement with a variety of government agencies. A more transparent approval process would encourage confidence for would-be investors.

- Recruit experienced developers to build and teach. Vietnam’s first large-scale renewables projects will need experienced developers to get them off the ground. Ideally, these developers should also commit to training local installation companies, thereby reducing capital costs associated with building subsequent renewables plants. This do-and-train model would create jobs in the sector and boost the country’s reputation.

This is a watershed moment for Vietnam—whether it decides to follow the current plan or a renewables-led pathway, the country will need to take action soon or risk potential issues with the power system. Renewables offer the country the prospect of less expensive, cleaner, and more secure energy pathway.

Source: McKinsey Sustainability